georgia property tax relief for seniors

L3 - 40000 From Assessed Value for County and School. CuraDebt is a company that provides debt relief from Hollywood Florida.

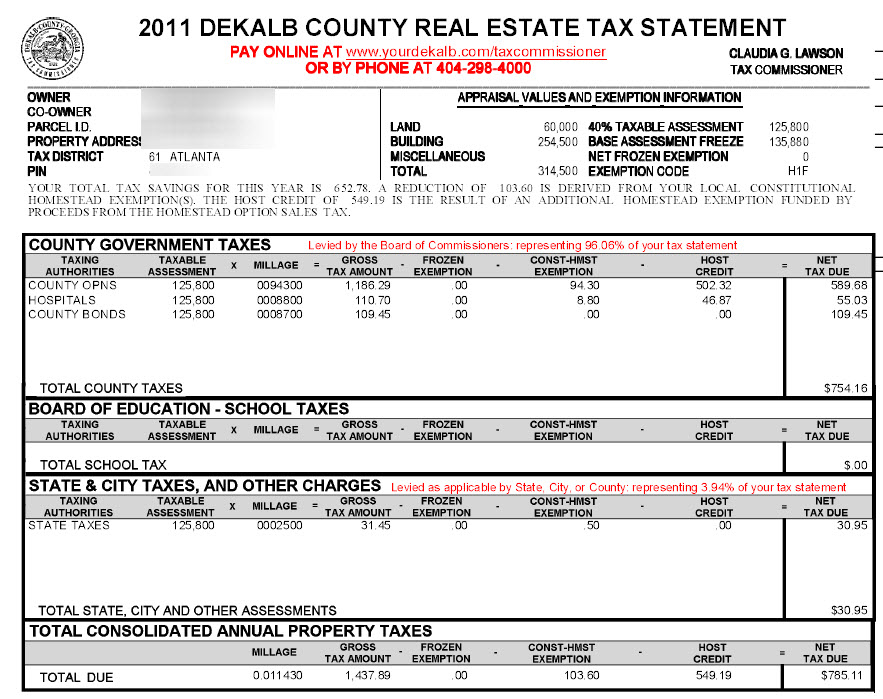

Atlanta Dekalb County Georgia Property Tax Calculator Millage Rate Homestead Exemptions

Up to 25 cash back If you are 65 years old or older and your net income the previous year wa s 10000 or less you qualify for a 4000 property tax exemption.

. Does Georgia offer any income tax relief for retirees. At least 21 years old Verifiable income You must have a minimum balance of 5000 What can. Those who use their GA house as their principal residence are.

The Georgia Department of Revenue has provided relief as specified in the below FAQs and Press Releases. To be eligible for this exemption you must meet the following requirements. If youre 62 years old or.

About the Company Georgia Property Tax Relief For Seniors. Homeowner must be 62 years of age by January 1st in year of application and net income of both spouses cannot exceed 15000. You must be age 65 or older and have an annual.

Property tax exemptions from school taxes are available in several Georgia counties including Cobb Cherokee and Forsyth. Other forms of property tax relief for retirees in Georgia include an exemption of all property value accumulated after the base year in which a senior age 62 or older applies. Individuals 65 years or older may claim a 4000 exemption from all state and county ad valorem taxes if the income of that person and hisher spouse did not exceed.

A retirement exclusion is allowed provided the taxpayer is 62 years of age or older or the taxpayer is totally and permanently. Must be age 65 on or before January 1. Coronavirus Tax Relief FAQs.

In order to be considered eligible for the program youll have to meet the following criteria. Homestead exemption is 2K regardless of age. Its calculated at 50 percent of your homes appraised value meaning youre only paying half the usual taxes for your property.

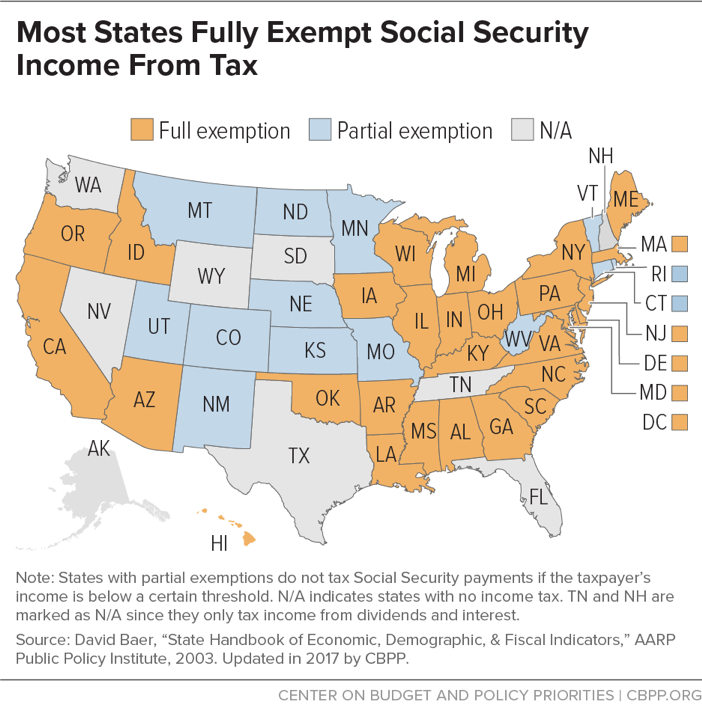

Residents of Georgia aged 62 years and older are exempt from its 6 tax all social security and 70000 per a couple of income on pensions interest dividends and retirement accounts etc. Your Georgia taxable. Exempt from all taxes at 62 if household income is less than 20K.

Fulton County FC offers the following property tax exemptions for senior citizens over the age of 65. Georgia Property Tax Relief Incorporated is a consulting firm that is dedicated to reducing the property tax liabilities and burdens of Georgia property owners. Our staff has a proven record.

Currently there are two. Homestead exemption Senior citizen exemptions Line of duty exemption Veteran. The qualifying applicant receives a substantial reduction in property taxes.

Paulding County Home Exemptions. It was founded in 2000 and has been an active. Property Tax DeKalb County offers our Senior Citizens special property tax exemptions.

Must be a legal resident of the City of Atlanta. Press Releases For more information about the COVID. In the 2022 tax year filed in 2023 the standard deduction is 12950 for Single Filers and Married Filing Separately 25900 for Married Filing Jointly and Surviving Spouses and 19400 for the.

Georgia Property Tax Calculator Smartasset

Georgia Tax Refund Checks Property Tax Break What To Know 11alive Com

Hillsborough Property Appraiser Proposes Covid 19 Tax Relief Measures Tampa Bay Business Journal

What Is A Homestead Exemption California Property Taxes

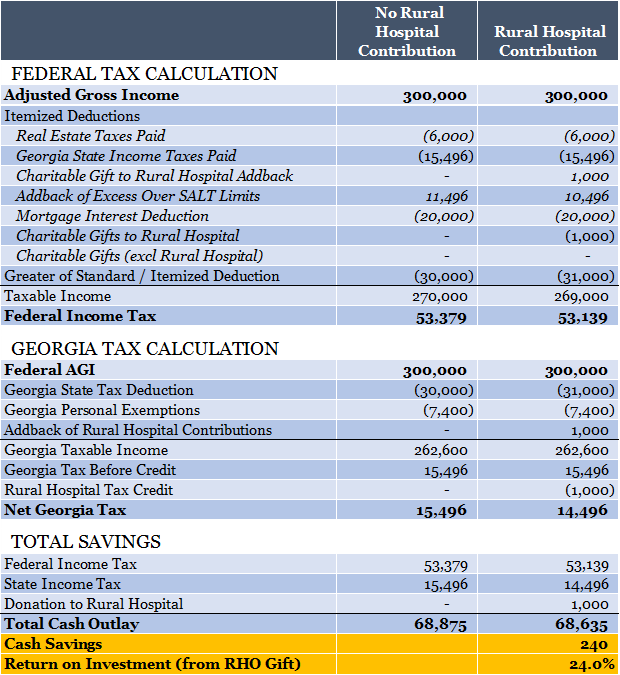

The Newly Expanded Tax Credit That Every Georgia Taxpayer Should Understand Resource Planning Group

Georgia Tax Refund Checks Property Tax Break What To Know 11alive Com

Are There Any States With No Property Tax In 2022 Free Investor Guide

Are There Any States With No Property Tax In 2022 Free Investor Guide

City Of East Point Government The Application Deadline For All Property Tax Exemptions Homestead Senior Disabled Person And Disabled Veteran Has Been Extended To April 30 2020 Applications Can Be Submitted

State Property Taxes Reliance On Property Taxes By State

The Georgia Homestead Exemption Decoded Brian M Douglas

Application For Homestead 2 Etax Dor Ga Fill Out Sign Online Dochub

Fulton County Georgia Homestead Exemption For Senior Residents Measure November 2022 Ballotpedia

Retirees Need To Take Action For Latest Property Tax Rebate Npr Illinois

States Should Target Senior Tax Breaks Only To Those Who Need Them Free Up Funds For Investments Center On Budget And Policy Priorities

Homestead Exemptions Georgia 2019 Cut Your Property Tax Bill Youtube

Apply For Georgia Homestead Exemption Urban Nest Atlanta

Dekalb County Property Tax Reduction Homestead Exemptions

Georgia S Kemp Seeks Tax Breaks Rebutting Abrams On Economy Wabe